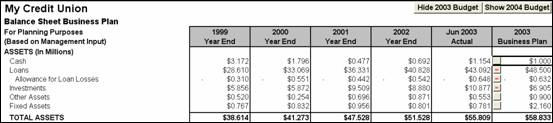

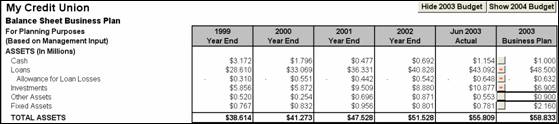

The next step in the Insight Planning Process is to use the Balance Sheet and Income Statement to complete the financial components of the credit union's business plan.

The purpose of the Balance Sheet is to provide the planners with a tool to project the Credit Union's financial position based on the achievement of member loans and savings growth goals.

The purpose of the Income Statement is to provide the planners with a tool to project the credit union's net operating results for the current and planned year and the impact on the credit union's future net capital position. The Income Statement presents the major elements of credit union operations, (i.e. loan interest income, investment interest income, other operating income, member dividends and interest on borrowed money, operating expenses, provision for loan losses and other non-operating income or loss).

Let

me show you how these features work together to establish financial goals

for the credit union.

The goals that were previously entered for Savings growth on the (S) sheet are imported into the financial statement.

The estimated yield for specific share types that was entered into the (S) sheet produced an overall cost of funds...

...which becomes the budgeted cost of funds for the income statement.

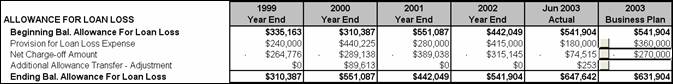

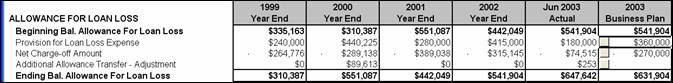

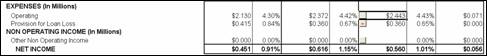

Insight provides features that help you to estimate net charged-off loans and create the budgeted amount for the Provision for Loan Loss expense, which will result in a goal for the Allowance for Loan Loss balance at the end of year.

The net charged-off loan figure (charged-off loans minus estimated loan recoveries) for the business plan year will be estimated and entered here.

The Provision for Loan Loss expense that the credit union estimates to be adequate for the year is entered here.

The resulting ending balance in the Allowance for Loan Loss should be an adequate estimate of loan losses that the credit union will experience over the life of the loans. Usually in credit unions the life of the loan portfolio is 18-24 months. If the Allowance for loan loss is not adequate, further adjustments can be made to the Provision.

The amount that was entered in the Provision for Loan Loss is now the amount of expense for the Provision for Loan Loss on the Projected Income Statement.

The next process in building the business plan is to project the Balance sheet to the end of the year. Insight helps you to extend cash to the end of the year...

...and then extend other assets to the end of the year.

You then have an opportunity to consider if the Non-Earning Assets will increase, i.e., is the credit union buying land, building an office, or converting computer systems during this year? The estimated amount of non-earning assets for year-end would be entered here.

You can then extend other liabilities to the end of the year.

![]()

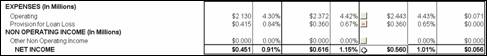

Back on the Income Statement, you can determine the amount of Fee & Other Income that the credit union can expect this year.

![]()

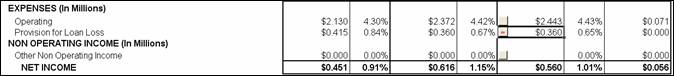

Next, on the Income Statement, you would determine your operating expenses based on a detailed review of anticipated operating expenses...

...and then determine the amount of non operating income for this year.

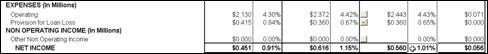

You can then check to ensure that the resulting net income and...

...the resulting ROA...

...support the long-term growth goals?

If they do, you would be finished with your financial goals for the current year.

Insight

also includes features which help you to estimate your Delinquency Percentage

on the H sheet...

![]()

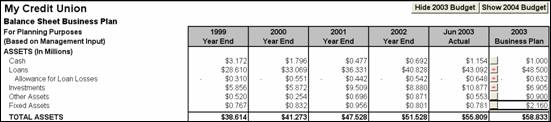

...and complete your projection of the credit union's current year-end Financial Statement by calculating equity on the Balance Sheet

![]()